Economic Competition

Constructive economic competition in domestic markets and foreign trade

An Article in the Compendium of Market-Based Social-Ecological Economics

Key issues in view of the neoliberal crisis:

How can we guarantee employment and fair income?

How can we protect the environment effectively?

How should we shape the economic globalization?

What should the economic sciences contribute?

What must be the vital tasks of economic policy?

How can we legitimize economic policy democratically?

Click here for the list of all articles: Compendium

Click here for the German-language version: Wirtschaftlicher Wettbewerb

Table of Contents

|

Abstract

In the course of the neoliberal globalization, national as well as supranational competition regimes dissolve. The concentration of corporate capital increases, monopolistic structures spread. “Liberalized” global markets turn into battlefields, on which competitors displace, conquer and destroy each other. The constructive function of competition, intended to promote progress and welfare, moves out of focus.

2. Definition and Economic Importance

Constructive economic competition takes place on markets where at least two suppliers (sellers) and two demanders (buyers) attempt to enforce their supply or demand antagonisticly and at the expense of their competitors. A market on which only one seller or one buyer is active is a market without competition, a socalled monopolistic market, because the sole player (the monopolist), be it a seller or a buyer, is in a position to dictate prices and other conditions at the expence of all other players. It therefore follows that the more buyers and sellers are participating in trade, the less influence each player has on pricing, hence, prices are calculated more fairly and are macro-economically more beneficial, and the competition is all the more constructive.

In order to create economically constructive incentives for competition, the conflicting (antagonistic) element of market-based competition has to be embedded into a binding economic and competitive order that imposes a framework of rules and standards aimed at social welfare. That is, the freedom of market participants must not be an absolute, lawless (anarchic) freedom, but a freedom that ensures that the profits from private sector transactions in total generate macro-economic gains at the same time. Under these conditions, the competitive order must, on the one hand, prevent monopolistic and oligopolistic structures (cartels), so that competition can unfold freely and comprehensively, on the other hand, it has to restrict competition in markets where scarce goods are traded, for example, in the housing rental market, or it even needs to set up state monopolies, for example, for services of general interest such as the supply of clean water.

As already indicated, not only the price is decisive for the success in competition, but also the product quality, the payment and delivery terms, the assured guarantees and/or warranties, and the various services offered during the life cycle of products. In other words, the creative design of competitive advantages by market participants is crucial for the success in a given competitive situation.

|

The regulation and control of market-based competition is vital because market participants tend to escape the risk of competition through mergers, collusions and discrimination due to their natural striving for expansion and profit. In the eighteenth century, the Scottish economist Adam Smith had already pointed out that this tendency is counterproductive.. |

Effective regulation aims at the greatest possible distribution of economic power and economic capital, at efficiency and productivity, at progress and full employment, at a diverse range of products, at the greatest possible scope of distribution of wealth and public services, and alltogether at social welfare. The lawyer Franz Böhm, a representative of the Freiburg School of economics, has referred to competition as »the greatest and most ingenious instrument of disempowerment in history«.

However, the conditions for a market-based competitive order can only be established under a democratic constitution garanteeing freedom and the rule of law. The conditions include, on the one hand, the freedom of information, of establishment, of contract, of market access, the freedom to own property, to pursue business and trade, and to choose an appropriate organizational form, and on the other hand the obligation to avoid damages of social and environmental resources and to be liable for any self-inflicted damages – preferably to be enforced by (tax) incentives and sanctions. The freedoms referred to are not to be understood as unrestricted and absolutist – as is the case under the neoliberal doctrine –, but rather as freedoms in the context of a regulated market-based economic system, in particular concerning the balance between private and public interests and goods.

A market-based economic system is considered sustainable and future-proof when economic activities are controlled such that social and environmental costs are allocated to the cost-incurring market participants and consequently motivate them to avoid such costs. Under strict socio-ecological control sustainable economic returns rather than costs can be generated in the long term, resulting from a higher quality of production processes and products as well as from the preservation of natural resources. Therefore, economic returns are to be equated with a higher quality of life.

In order to assign the necessary individual responsibility to all market participants, decentralized economic structures, or more precisely: subsidiary economic structures, are imperative – as opposed to the centralized structures of the neoliberal system. For more details I recommend the article Economic Subsidiarity.

The effective building of subsidiary economic structures under the conditions of the neoliberal globalization as a base for a post-neoliberal economic order is addressed in the article Building Subsidiary Economic Structures.

|

Only on the basis of subsidiary economic structures a competition regime provides

|

|

And only under such controlled conditions will competition motivate economic players to be creative as well as disciplined. And only under such controlled conditions can economic competition be ethically justified without reservations. |

Binding economic and competitive orders can only be enforced within autonomous economic areas which maintain their own currency. Economic autonomy is the absolute requirement to establish uniform conditions in domestic markets and, at the same time, to subject foreign trade transactions to these conditions. Since uniform conditions can not be established across borders, international trade has to be governed by bilateral and multilateral trade agreements being negotiated and agreed upon between autonomous economies areas. In these negotiations each economic area can impose its own conditions which may lead to trading activities, if they are accepted by trading partners, and exclude trading in areas over which no agreement is reached. Entrepreneurial players who face up to international competition have in fact an indirect influence on trading conditions as part of their general political participation, but should definitely not be allowed to determine them arbitrarily.

I would like to stress again that future-proof free markets, as defined here, can only be established domestically due to the required economic autonomy. And: the adjective »free« refers only to the fact that economic players can assign their productive factors freely (see above) in the context of economic control and regulation. The aspired ideal of a free social-ecological market economy can be accomplished when control and regulation are focused on sustainable social welfare – which absolutely includes the welfare of the natural environment. However, the freedom of market participants in a social-ecological market economy should not be confused with the absolute and doctrinaire freedom granted by the neoliberal system. A freedom that results from the deregulation (»liberalization«) of economic processes and consequently reduces economic life to a warlike state of economic anarchy.

|

Competition can fulfill its constructive function only within in a free social-ecological market economy. As such, it promotes constant renewal and progress, increasing efficiency of labor input and resource and capital use, growing productivity of production processes, better and more useful products, and generally qualitative growth and sustainable welfare. |

3. Competitive Strategies / Competitive Advantages

In order to compete effectively, market participants need to strategically position themselves in a clear manner. Suppliers can basically choose between a strategy of qualitative differentiation and a strategy of cost leadership. The two strategies are mutually exclusive, that is, market participants who fall between the stools will usually fail.

The strategy of qualitative differentiation: This strategy aims at an exceptionally high quality, in fullest possible compliance with customer requirements, combined with a cost optimization at all stages of the value chain (research, development, manufacturing, marketing, distribution and maintenance). Market shares to be achieved with this strategy are typically smaller than those from the strategy of cost leadership, but, on the other hand, price bonuses to be realized are typically much higher.

The strategy of cost leadership: This strategy aimes at high revenues and high market shares in mass markets through economies of scope and economies of scale, that is, through the lowest possible unit costs resulting from the highest possible volumes. However, the minimized production costs should be combined with a minimum, just about acceptable compliance of customer requirements. Price bonuses to be realized with this strategy are lower than those from the strategy of qualitative differentiation.

Enterprises can act as a market pioneer or a market follower within either of the two strategies. Pioneers initially have to bear higher costs at all stages of the value chain, particularly in research and development, but they can capture new markets without being constrained by competitors and establish themselves as market leaders, even if only temporarily. Followers can adopt established conditions and requirements as well as experience already gained by pioneers, and can therefore avoid pioneer costs and use this advantage to acquire market share.

Regardless of the strategies implemented by suppliers, the following, as already mentioned, applies: The more buyers and sellers participate on a particular market at a particular time, the more constructive competition becomes with respect to optimum prices, conditions, product features and product qualities. Subsidiary structures ensure that suppliers’ as well as demanders’ cartels can mostly be avoided and antitrust enforcement minimized.

|

It should be noted that the strategy of cost leadership with its economies of scope and scale in particular can only contribute to sustainable welfare when realized within a framework of subsidiary economic structures based on a corresponding economic and competitive regime. |

4. Competition in Domestic Markets

In domestic competition within homogeneous economic and monetary areas the absolute price advantage (and indirectly the absolute productivity advantage) is decisive for the success of a supplier, provided product qualities are comparable. The selection and learning process associated with competition, during which non-successful enterprises lose market share or are completely forced out of a market, offers double benefit on domestic markets: First, because it continuously improves production processes and product supplies, but also because it helps defeated market participants to learn from failures and size new opportunities – possibly on different markets or in a different business function – without irrevocably excluding individuals from economic life.

|

Free markets can only be realized domestically because the freedom offered to economic players in allocating productive factors can only be directed towards sustainable welfare as part of an autonomously designed market economy and competition regime! See also the article Sustainable Social Welfare. |

5. Competition in Foreign Trade

However, in international competition, induced by foreign trade, not only individual buyers and sellers compete against one another but also the differing traditions and characteristics of economic and currency areas. Areas and countries have different resources available and are differently developed, and their economic life follows different rules and standards. It is obvious that international competition, given the desirable worldwide diversity, should not be governed by absolute price and productivity advantages. Therefore, it is essential for global welfare that price differences that naturally exist between economic areas (as a result of different levels of productivity) be neutralized through precisely calculated exchange rates and, in addition, be adapted to domestic competitive conditions on a case-by-case basis through autonomously specified tariffs and trade quotas. In this way, differences in productivity are indirectly neutralized and international competition is determined through relative price advantages. Moreover, the fruitful regional diversity and vitality can be developed further and serve as a foundation of international trade and competition. The principle of relative price advantages is covered in the article Comparative Advantage – upgraded.

|

In terms of sustainable gains from trade and sustainable social welfare there can be no absolutely free markets and no free use of productive factors on a global scale. Rather, foreign trade and international competition must be governed by bilateral and multilateral trade agreements! |

6. Competition and Cooperation

These two principles of economic success are often portrayed as irreconcilable, recently even played off against each other using the catchphrase »cooperation instead of competition« – presumably under the impression of the devastations caused by todays neoliberal competition. These perceptions are misleading since economic life is dependent on both principles: competition and cooperation – but in fact with different focal points compared with the private and social sphere, which makes for more confusion.

In a free social-ecological market economy it’s the obligation of economic governance and regulation to motivate the entrepreneurial players under a regime of competition to organize their material and immaterial value creation for maximum social and environmental efficiency and corresponding maximum cost and price advantages. This mission is most effectively fulfilled by counteracting the »natural« tendency of economic enterprises towards capital concentration and cartels, so that an optimally large number of suppliers is competing in any industry and sector at any time. This ensures that competition induces maximum progress. Cooperation is most effective when it induces further progress in addition to competition but without hindering the latter. For example, when technologies and prototypes of products are jointly developed pre-competitively – most of all, when such joint ventures are of great macroeconomic (national) relevance and the development effort is beyond the capabilities of individual enterprises.

7. The Key Instrument of the Competition Regime

The competition policy is central to the economic order and must therefore be equipped with its own executive. This executive must be able to exercise power far beyond the powers of today’s federal and regional anti-trust (anti-cartel) authorities. Meaning, it must be responsible for the enforcement of domestic market economy rules broken down by industry and sector and, equally essential, for the enforcement of normative guidelines for international agreements in foreign trade.

I shall confine myself here to the presentation of domestic control and regulation of economic structures. Regarding the foreign trade rules, I refer to the article Future-Proof Foreign Trade.

Domestic competition policy is responsible to ensure the greatest possible number of suppliers and demanders in any industry (polypolistic structure) in order to intensify competition and promote progress. A large number of competitors is to be equated with an optimally decentralized industry structure, that is, with an area-wide equal distribution of capital and property, with local competition, with local responsibility for society and environment, and with local conformity between labor demand and labor supply, therefore with full employment.

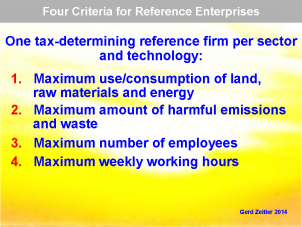

Figure 1: The most effective means of decentralizing value creation dynamically and permanently for the benefit of competition is a progressive taxation of those business parameters that have a negative impact on competition and, even more, on society and environment. For this purpose, the smallest possible companies have to be defined per industry and production technology on the basis of business parameters to serve as fiscal benchmark companies. »Benchmark companies« means that the (small) companies defined could in fact exist in any industry, but if they really do is insignificant for the purpose pursued here.

Figure 1: The most effective means of decentralizing value creation dynamically and permanently for the benefit of competition is a progressive taxation of those business parameters that have a negative impact on competition and, even more, on society and environment. For this purpose, the smallest possible companies have to be defined per industry and production technology on the basis of business parameters to serve as fiscal benchmark companies. »Benchmark companies« means that the (small) companies defined could in fact exist in any industry, but if they really do is insignificant for the purpose pursued here.

Two complex ecological and two simple social parameters are sufficient for this purpose, as shown in the figure. Regarding the social parameters it should be noted that, if the reference number of employees that results from the respective production requirements of an industry is exceeded, the tax burden increases progressively and provides incentives to split up companies in terms of subsidiarization (decentralization) of economic structures (socalled cell division). Likewise, if the reference number of weekly working hours calculated from the respective industrial productivity is exceeded, the tax burden increases to ensure an equitable distribution of workloads and thus full employment.

In addition to the dynamic subsidiarization (decentralization) of economic structures, natural resources should be taxed at a level high enough to sustainably preserve their substance.

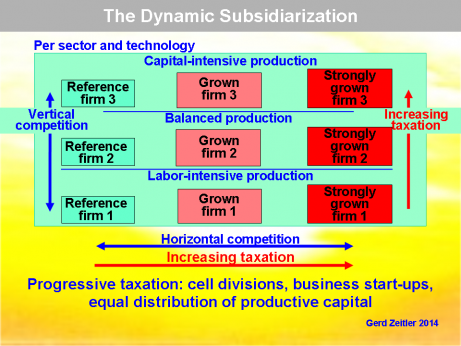

Figure 2: In practice, the further companies exceed the predetermined reference parameters, the more heavily they are progressively taxed. The tax burden forces them sooner or later – depending on their own efficiency and productivity – to scale back the exceedance of parameters or to split up companies into independent units for disposal. The capital gains from disposals should be primarily invested in qualitative growth, rather than be added to private income which is also subject to progressive taxation. The systemic splitting up of companies creates unique opportunities for business start-ups and entrepreneurs to acquire fully operative units and to intervene in the marketplace. Thus, a constant dynamic subsidiarization of economic structures and a continuous renewal of economic value creation is induced simply through progressive taxation.

Figure 2: In practice, the further companies exceed the predetermined reference parameters, the more heavily they are progressively taxed. The tax burden forces them sooner or later – depending on their own efficiency and productivity – to scale back the exceedance of parameters or to split up companies into independent units for disposal. The capital gains from disposals should be primarily invested in qualitative growth, rather than be added to private income which is also subject to progressive taxation. The systemic splitting up of companies creates unique opportunities for business start-ups and entrepreneurs to acquire fully operative units and to intervene in the marketplace. Thus, a constant dynamic subsidiarization of economic structures and a continuous renewal of economic value creation is induced simply through progressive taxation.

To spell it out again: The kind of qualitative decentralization proposed here is in fact a subsidiarization of economic structures, that is, the entire value creation, differentiated by technologies, is generated on the lowest possible level of production. Furthermore, the technological differentiation is used for an additional progressive taxation by taxing capital-intensive productions more heavily than labor-intensive ones. Thereby, productions of different capital intensity, including their products, can not only co-exist, but can vertically (across different subsidiary levels) compete with each other. The above figure shows the vertical and horizontal tax progression and the vertical and horizontal competition.

8. Competition under the Neoliberal Doctrine

It is characteristic of the neoliberal system and its doctrine of »market liberalization« that the dividing line between domestic and international competition is blurred, instigating a worldwide competition based on price advantages in the quasi-reserve currency US dollar. With open financial markets and an open trade system bilateral exchange rate regimes can not be maintained and bilateral trade agreements lose their meaning. Inevitably, inhomogeneous supranational and global markets evolve on which economies with incompatible productivity levels meet without being able to protect themselves against cut-throat competition.

The competition for price advantages in reserve currency is actually a competition for absolute advantages because exchange rates between national currencies and reserve currency are exposed to chaotic speculation on deregulated financial markets, making bilateral agreements on precisely calculated exchange rates impossible. The resulting uncertainty among suppliers additionally boosts their tendency for price dumping to stay reasonably competitive even with unfavorable exchange rates. That’s why the price in US dollars is ultimately decisive for the success in (neoliberal) international competition, and why constructive competition for relative advantages, as described above, is excluded (see also the article Economic Pricing).

Absolute advantages can be won across borders in only two ways (provided endowment with resources and technologies is similar): On the one hand through economies of scope, economies of scale and territorial specialization, i.e. through mass production of standardized products in large production units, accompanied by a desertification of geographical areas including unemployment caused by tough competition that does not allow for shorter working hours and wage increases if productivity increases. On the other hand through targeted lowering of labor costs as well as social and environmental standards, so-called locational advantages, with the result of precarious wages, unequal distribution, poverty and environmental pollution.

As a compliment I recommend the article Scale Economies and Productivity.

|

The result of the doctrinal »market liberalization« is a global competition for extreme concentration of economic power and capital by means of mergers and acquisitions of businesses, associated with a competition for the most ruthless national dumping. And because cost pressure is steadily increasing in this competition, enterprises driven out of their market, including their jobs, will usually be lost forever. |

The overall context of economic policy needs is briefly described in the article Ten Imperatives to Secure Our Future.

Note on the COVID-19 Pandemic

The pandemic has noticeably revealed the significant weaknesses of the neoliberal economic system for everyone, above all the shortage of medical, but also other products, caused by disruptions in the absurdly networked value and supply chains across the globe.

The analyses of the neoliberal system as well as the principles and practical procedures based on them for building a sustainable system, which are presented in this compendium, thereby obtain an unexpected topicality. Now is the time to seize the opportunity and build up economic policy pressure to enforce the development of an economic order that is sustainably oriented towards social and ecological welfare.

The following article refers to the targeted arguments contained in the Compendium: COVID-19 and Globalization

___________________________________________________________________________________

Click here for the German-language version: Wirtschaftlicher Wettbewerb